PROPERTY MANAGEMENT CHECK-IN/OUT HOUSEKEEPING

WE ARE LOOKING FOR NEW FACILITIES TO MANAGE FOR SHORT TERM RENTAL

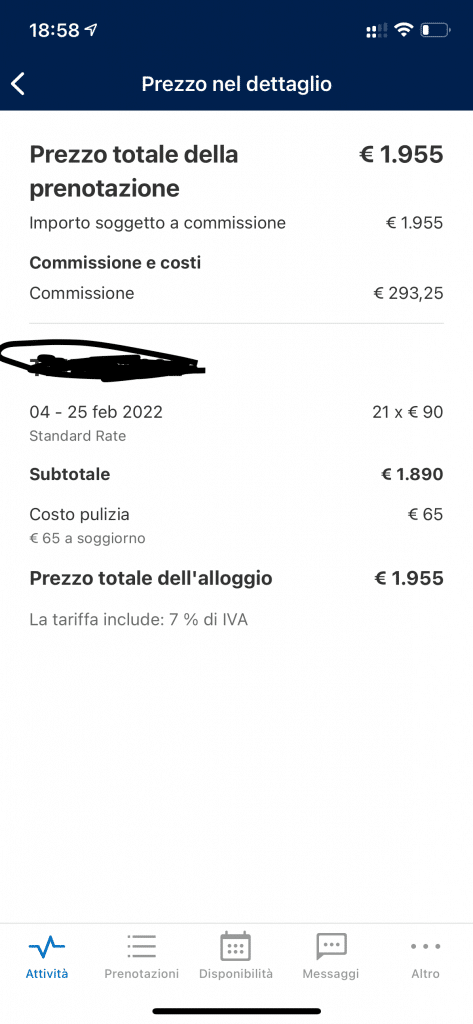

“PROPERTY FOR SALE GRAN CANARIA” is actively seeking new facilities to be manage for short-term tourist rental, including Villas, Chalets, Bungalows, Apartments, Duplexes and Triplexes. We offer management contracts lasting at least 12 months to ensure stability and continuity for owners. In addition to managing bookings on portals, social and our institutional website, check-ins and check-outs, ready interventions to the property and guests, we also take care of housekeeping through our company, and the fiscal management for payment of taxes on the revenue generated, providing a full 360-degree service.

Our areas of interest include in the South Meloneras, Playa del Ingles, Campo Internacional, Sonnenland, Puerto Rico, Amadores, Salobre Golf, and San Agustin; in the North Playa de Las Canteras and Santa Catalina.

If you own a property in one of these areas and are interested in having us manage your property for tourist rentals, please do not hesitate to contact us, and we will be happy to schedule an appointment at our Playa del Ingles offices or a phone call or Skype to discuss it together and evaluate the possibilities of collaboration.

Don’t let your property only generate expenses, start it in the business of short rentals by relying on a serious and professional partner who will take care of everything by relieving you of any practical and bureaucratic tasks.

The law in Gran Canaria establishes precise rules for short-term rentals to tourists and we follow them strictly by dealing with the application for the Vivienda Vacacional license, the registration of guests, the alignment with the guidelines regarding the accommodation, its set up, insurance, etc… so that you sleep soundly and our work is done legally safe from fines and complaints.

Contact us for more information at our phone or email contact information

+34 635632009 +39 3518711023